Nissan Australia has revealed local pricing and specifications for the new-generation Navara ute. Now twinned with the Mitsubishi Triton, the new Nissan Navara features Australian-tuned suspension by engineering company Premcar for “more capability” than before, but also a gruntier 150kW twin-turbocharged diesel engine as standard. The new Navara will go on sale in Australia from March 1.

Four models will be available initially, with familiar SL, ST, ST-X and Pro-4X names on offer and the off-road Warrior due later on. Unlike the previous model, the new Navara will only be available in dual-cab turbo-diesel automatic four-wheel drive form, with two-wheel drive, manual and single cab variants no longer offered.

Every 2026 Nissan Navara uses a 2.4-litre twin-turbocharged four-cylinder diesel engine making 150kW of power (@ 3500rpm) and 470Nm of torque (@ 1500rpm). That’s mated to a six-speed automatic transmission, with claimed combined fuel consumption rated at 7.7L/100km and CO2 emissions of 203g/km.

Like the Triton on which it’s based and most of its competition, the Navara can tow a 3500kg braked trailer, with a 3100kg gross vehicle mass (GVM) and a gross combination mass (GCM) of 6250kg. Unlike the Triton, the Navara’s suspension has been locally tuned by Premcar with three combinations chosen: a heavy-duty version for the SL and ST, one to account for the ST-X’s larger wheels and one for the off-road Pro-4X.

Pricing for the new Nissan Navara starts at $53,348 plus on-road costs for the entry-level SL, with the top-spec Pro-4X priced at $68,418 +ORC. Nissan has highlighted the value on offer with the new Navara, nothing that it’s more richly equipped than equivalent Triton models.

That’s particularly noticeable comparing the $56,765 +ORC Navara ST to the $57,240 +ORC Triton GLX-R, with the Navara adding LED lighting, heated mirrors with automatic-folding functionality, a leather steering wheel, an auto-dimming rear mirror, tailgate assistance and a carpet floor over the Mitsubishi that it’s twinned with.

Like other new Nissan products, the Navara is covered for up to 10 years/300,000km of warranty, and up to 10 years of roadside assistance (both if it’s serviced at a Nissan dealership until then). The first five years of servicing costs $499 per service.

2026 Nissan Navara pricing (plus on-road costs):

| SL | $53,348 |

|---|---|

| ST | $56,765 |

| ST-X | $63,177 |

| Pro-4X | $68,418 |

2026 Nissan Navara SL standard features:

- 17-inch steel wheels

- ‘Easy Select’ 4WD system with 2H, 4H and 4L driving modes

- Automatic dusk-sensing LED headlights

- Automatic rain-sensing wipers

- Remote keyless entry

- Electronic locking rear differential

- Black fabric seat upholstery

- Height-adjustable driver’s seat with lumbar adjustment

- Vinyl floor covering

- Urethane steering wheel

- Automatic single-zone climate control with rear air vents

- 7.0-inch driver’s display

- 9.0-inch touchscreen with wireless Apple CarPlay and Android Auto

- AM/FM/DAB+ digital radio

- Satellite navigation

- Four-speaker sound system

- Tailgate assist

Navara SL safety features:

- 8x airbags

- Autonomous emergency braking

- Adaptive cruise control

- Lane keep assist with lane departure warning

- Blind-spot monitoring

- Front and rear cross-traffic alert

- Traffic sign recognition

- Intelligent driver alert

- Auto high beam

- 360-degree camera with moving object detection

- Tyre pressure monitoring

Navara ST model adds:

- 17-inch alloy wheels

- Heated/auto-folding mirrors

- Rear privacy glass

- Leather steering wheel

- LED front fog lights

- Auto-dimming rear mirror

- Carpet flooring

- Rear USB charging port

Navara ST-X model adds:

- 18-inch alloy wheels

- Rear sports bar

- ‘Super 4WD’ system with Torsen limited-slip centre differential

- Seven driving modes: Normal, eco, gravel, snow, mud, sand, and rock

- Keyless entry with push button start

- Leather upholstery

- 10-way power driver’s seat

- Heated front seats

- ‘MyNISSAN’ remote services

- Two extra speakers (six in total)

- Wireless phone charger

- Tub-liner

- Carpet floor mats

- Closed upper glove box

Navara Pro-4X model adds:

- 17-inch matte black alloy wheels fitted with 265/65R17 all-terrain tyres

- Tow bar with wiring harness

- Unique Pro-4X exterior styling with lava red orange accents, black roof rails, and a ‘NAVARA’ tailgate badge finished in black with red accenting

- Orange stitching on the seats and steering wheel

- Suede trim inserts

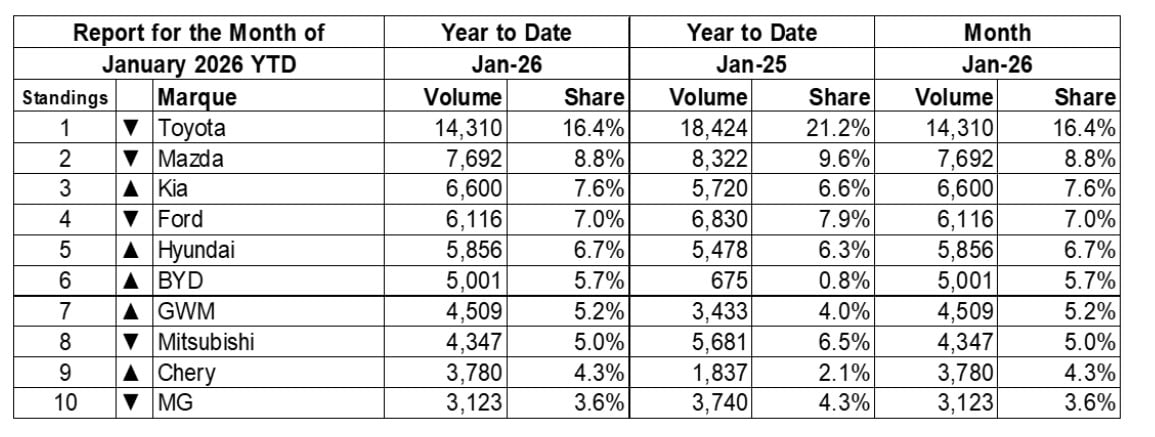

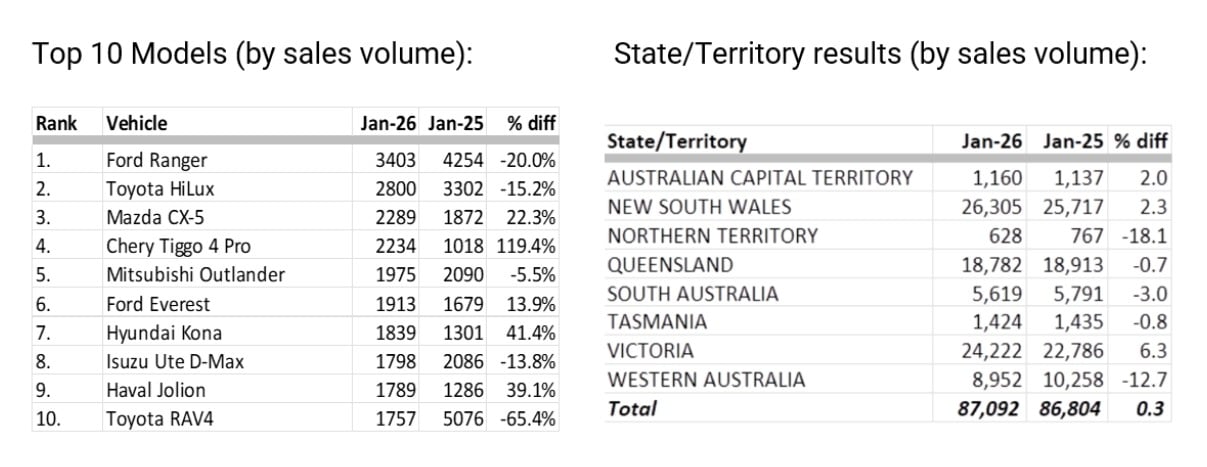

Cars imported from China are continuing their surge up the new car sales charts with data from the Federal Chamber of Automotive Industries (FCAI) and Electric Vehicle Council (EVC) showing that just under 21,000 cars sold in Australia in January were made in China, up a massive 68.6 per cent over the same period last year.

Four of the top 10 selling brands in Australia are now from China, with BYD in sixth place ahead of GWM in seventh. Chery holds down ninth spot while MG rounds out the top 10.

Japanese-built cars continue to lead the way, although sales of 22,394 vehicles showed a marked drop, down 24,6 per cent year-on-year.

In third place, cars imported from Thailand – which had previously held down second spot – also recorded a modest drop, down 7.7 per cent with just over 17,000 sales.

China’s growth comes on the back of strong results for BYD (5001 sales, up 640.9 per cent), Chery (3780, up 105.8), and GWM (4509, up 31.3) while newcomers such as Zeekr (469 sales), Omoda Jaecoo (691), and Geely (720) also posted strong January results.

Of the Japanese brands, Toyota posted a 22.3 per cent drop in sales compared with last year, thanks largely to the imminent arrival of the new-generation RAV4 which has seen sales of runout models slow as stock levels are depleted. There’s more pain likely ahead for Toyota, with the new RAV4 not due to hit dealerships until sometime in April.

Other brands including Mazda (down 7.6 per cent), Mitsubishi (down 23.5), Nissan (down 38.4) and Suzuki (down 36.5) also lost market share.

Of the top five brands in Australia in January, only Hyundai (up 6.9 per cent) and Kia (up 15.4) improved over their January 2025 results.

Top 10 Countries of Origin – January 2026

1 Japan – 22,943

2 China – 20,921

3 Thailand – 17,072

4 Korea – 11,277

5 Germany – 4346

6 USA – 2239

7 Mexico – 1709

8 South Africa – 1047

9 England – 584

10 Turkey – 565

BMW appears to be closing in on the reveal of the next-generation 3 Series, with near-production versions of the all-electric BMW i3 now rolling off the assembly line in Munich. The camouflaged vehicles mark the first tangible glimpse of the electric sedan that will spearhead BMW’s Neue Klasse era and signal a significant technological reset for the brand’s most important model.

Despite the familiar name, this new i3 bears little resemblance to BMW’s earlier city-focused EV. Instead, it will serve as the electric counterpart to the next 3 Series sedan, sharing design language and core technology with the upcoming iX3 electric SUV. Both models form part of BMW’s broader plan to introduce around 40 new or updated vehicles globally by 2027.

According to BMW executives, the i3 is intended to restore the dynamic character that made earlier generations of the 3 Series a benchmark. The new platform has been engineered specifically for electric drivetrains, with a focus on agility, steering feel and driver engagement – qualities BMW believes have been diluted in some modern EVs.

Importantly, BMW is not abandoning combustion power. Petrol-powered versions of the next 3 Series are also in development, including a future M340 variant using a six-cylinder turbocharged engine. A Touring wagon will follow, along with a flagship M3 due in 2027 that will, for the first time, be offered with both petrol and electric power. The electric M3 – known internally as the iM3 – is expected to use four electric motors and deliver outputs approaching 750kW.

Visually, electric and petrol versions of the 3 Series will look closely related. Both will adopt BMW’s new Neue Klasse styling, previewed by a 2023 concept, featuring a slimmer and wider interpretation of the kidney grille that integrates driver-assistance sensors. Subtle proportion changes will distinguish the EV, including a shorter bonnet and more pronounced wheelarches, while combustion models retain a longer front end.

BMW is taking an unusual approach under the skin. The electric i3 will sit on a dedicated EV platform, while petrol models will continue on an evolved version of the current architecture. Despite the different foundations, interior design and technology will be shared across the range, including BMW’s new Panoramic iDrive system. This setup projects key information along the base of the windscreen, supported by a centrally mounted touchscreen positioned to reduce driver distraction.

The i3 will benefit from BMW’s latest sixth-generation eDrive technology, using an 800-volt electrical system for ultra-fast charging. BMW claims vehicles using this hardware can add more than 400 kilometres of driving range in just 10 minutes under ideal conditions. Battery sizes have not been confirmed, but BMW is targeting a driving range comfortably beyond 800 kilometres if larger packs are fitted.

With the next Mercedes-Benz C-Class also set to go electric, the battle for the premium mid-size sedan segment is about to intensify – and BMW is clearly positioning the i3 to lead from the front.

Australian new car buyers are embracing electrified vehicles in unprecedented numbers and the surge in their uptake has come at the cost of petrol- and diesel-powered vehicles.

January new car sales data released today by the Federal Chamber of Automotive Industries (FCAI) shows that buyers are ditching traditional petrol-powered vehicles across all three main segments – passenger cars, SUVs and light commercial (dual-cab utes) – in favour of hybrid, plug-in hybrid and full battery electric vehicles.

Sales data records that Aussies bought 33,144 petrol and 24,439 diesel vehicles in January, down 14.7 and 3.7 per cent respectively compared with last year, continuing the trend of recent years, according to the CEO of the FCAI Tony Weber.

“January’s figures show a market that is stable, with Australians continuing to purchase vehicles that meet their needs for work, family and lifestyle,” he said. “We are seeing fewer petrol vehicles sold and rapid growth in plug-in hybrids, while uptake of hybrid and battery electric vehicles is more stable.“

In stark contrast, sales of electric cars were up 93.3 per cent year-on-year, recording sales of 7409 cars according to FCAI and Electric Vehicle Council. Conventional hybrid vehicles accounted for 15,121 sales, two per cent up over the same time last year.

The big winner continues to be the plug-in hybrid segment, with January sales of 5161 PHEVs representing a massive 170.5 per cent increase measured against the same time last year. Chinese auto giant BYD contributed around 43 per cent of total PHEV sales, the Shark 6 dual-cab ute recording 1108 sales, joined by a trio of SUVs, the Sealion 6 (706), Sealion 8 (247) and Sealion 5 (161).

It’s a similar story in the EV category, where BYD easily outgunned its competition, its 2779 sales accounting for 37.5 per cent of the total market for battery electric vehicles in January. Kia placed second with 535 sales ahead of Tesla’s 501, an unusually slow month of the US brand.

Jeep Australia has confirmed a series of updates for the 2026 Wrangler and Gladiator, introducing a mix of functional changes, subtle interior revisions and new colour options aimed at improving usability while retaining the brand’s long-standing off-road focus. The revised range also includes a limited-run Wrangler 85th Anniversary Special Edition, marking 85 years since the Jeep name first appeared.

Rather than a major redesign, the 2026 updates focus on practical improvements that reflect how owners use their vehicles, particularly when it comes to open-air driving and off-road touring. Both the Wrangler and Gladiator now feature quick-release door hinges as standard, allowing doors to be removed more easily for drivers who regularly switch between enclosed and open configurations.

Inside, both models receive minor cabin changes, with Tungsten-coloured stitching on the steering wheel replacing the previous red finish. The update brings a more subdued look to the interior without altering the overall layout or controls.

The Wrangler Rubicon benefits from a more substantial equipment upgrade. A heavy-duty steel front bumper is now fitted as standard, a feature previously offered as a paid option. The bumper adds extra protection for off-road use and reflects the Rubicon’s positioning as the most trail-focused variant in the Wrangler line-up. Jeep has also expanded the Wrangler’s colour palette for 2026, reintroducing several previously unavailable shades alongside a new limited-run colour.

The Gladiator Rubicon receives a different set of updates aimed at day-to-day convenience. A remote start system is now standard, while the internal storage setup has been revised. The updated tool and bolt storage solution is designed to better accommodate parts removed when taking off the roof, doors or windscreen, replacing earlier hard plastic trays with a more flexible zippered pouch. Like the Wrangler, the Gladiator also gains access to several bold paint colours for a limited time.

Mechanically, both models continue unchanged. The Wrangler remains powered by a 2.0-litre turbo-petrol engine, while the Gladiator retains its 3.6-litre V6. Core off-road hardware carries over, including Jeep’s Rock-Trac four-wheel-drive system, solid axles, underbody protection and, on the Wrangler, a front-facing off-road camera. Both models continue to feature a 12.3-inch infotainment screen running Uconnect 5 with wireless smartphone connectivity.

Jeep Australia has yet to confirm pricing or arrival timing for the updated range, with further details expected closer to the 2026 on-sale date.

De Tomaso has released the first images of its out-of-this-world V12 engine that will power its forthcoming P900 track-only hypercar. Looking like an alien predator from a sci-fi horror movie, the 6.2-litre naturally-aspirated V12 pumps out 900 horsepower (662kW), and revs out to an astonishing 12,300rpm redline.

The 6.2-litre V12, which runs only on carbon-neutral synthetic fuels, was developed in-house in collaboration with German engineering firm Capricorn Group. Weighing just 220kg, it’s claimed to be the smallest and lightest V12 ever made. That’s helped keep the total weight of the P900 to 900kg, giving it a perfect 1:1 power-to-weight ratio.

But the standout feature of the V12 is undoubtedly the Italtecnica Engineering designed exhaust manifold. It’s a complex arrangement, with 12 individual pipes channelling gasses to a single outlet. Fashioned out of heat-reflective Inconel 625 steel piping, the striking system wouldn’t look out of place on a Ridley Scott film set.

“A vision so bold it was said to be impossible,” De Tomaso wrote in a short statement on Facebook. “Sculpted for the eye, engineered for the ears.”

The Hong Kong-owned, US-based De Tomaso is building just 18 of its P900 track-only hypercar at its facility in Affalterbach, Germany. First revealed publicly in 2022, each carries a price tag in excess of US$3 million (A$4.27 million). Deliveries were initially slated to begin in 2023. In August, 2024 De Tomaso confirmed that both the P900 and its P72 hypercar had entered the production phase. Now, the first images of the ‘alien’ V12 offer the clearest indication yet the project is still proceeding.

Australia’s new-vehicle market has opened 2026 on a steady footing, with January sales showing only modest movement compared with the same period last year. According to data released by the Federal Chamber of Automotive Industries (FCAI), a total of 87,092 new vehicles were sold during the month, up 0.3 per cent year on year.

The result suggests consumer demand remains resilient despite cost-of-living pressures, with buyers continuing to prioritise vehicles that suit everyday needs, whether for work, family or lifestyle use. FCAI chief executive Tony Weber said the figures point to a broadly stable market rather than any sharp upswing or downturn.

While overall volumes were largely unchanged, the make-up of the market continues to evolve. Petrol-powered vehicles recorded a 14 per cent decline in January, reinforcing a longer-term shift away from traditional internal combustion engines. In contrast, electrified vehicles continued to gain traction, led by a sharp increase in plug-in hybrid sales.

Plug-in hybrids accounted for 5161 sales in January, representing 5.9 per cent of the market and a year-on-year increase of more than 170 per cent. Conventional hybrids also maintained strong momentum, making up 17.4 per cent of total sales. Battery electric vehicles held a relatively steady share at 8.4 per cent, indicating growth has plateaued for now after rapid expansion in recent years.

Weber said the data shows buyer preferences are shifting gradually rather than dramatically. Petrol vehicles are losing ground, plug-in hybrids are accelerating quickly, and hybrids and electric vehicles are settling into a more stable pattern of uptake.

The figures also highlight the changing origins of vehicles sold in Australia. China has now firmly cemented its position as the second-largest source of new vehicles, behind Japan, with sales of Chinese-built models rising 68.6 per cent over the past year. The growth reflects increasing acceptance of Chinese brands, particularly in value-focused and electrified segments.

Toyota remained Australia’s top-selling brand in January with 14,310 vehicles delivered, followed by Mazda, Kia, Ford and Hyundai. The Ford Ranger once again led the model charts, ahead of the Toyota HiLux and Mazda CX-5. Chery’s Tiggo 4 Pro continued its strong run, finishing among the five best-selling vehicles, alongside the Mitsubishi Outlander.

Sales results varied across states and territories. Victoria and New South Wales recorded modest growth, while Queensland and South Australia edged lower. Western Australia and the Northern Territory saw more noticeable declines, underscoring how regional conditions continue to influence buying behaviour.

Overall, the January figures point to a market in transition rather than contraction, with electrified vehicles playing an increasingly important role in shaping Australia’s new-car landscape.

Adrian Portelli’s push into Australia’s fuel market has taken a tangible step forward, with the first LMCT+ branded service station beginning to emerge in Melbourne’s inner north. As revealed in an Instagram post by Portelli, new signage has appeared at a former Shell site on the corner of Gower Street and Plenty Road in Preston, marking the first physical location tied to the membership-based brand’s fuel ambitions.

The move follows months of speculation across LMCT+ social media channels, where cryptic posts and captions such as “LMCT+ Petrol incoming” hinted at a national rollout. When images of the Preston site were shared online, reaction from followers was immediate with comments demanding cheaper fuel, custom blends and calls for Portelli to take on Australia’s broader cost-of-living pressures.

In one teaser post, Portelli’s brand wrote, “If they don’t comply, make them regret it,” fuelling speculation the venture is aimed directly at challenging established fuel retailers.

Portelli has previously said the idea was born out of frustration with major petrol chains, claiming they were unwilling to offer meaningful discounts to everyday motorists. According to LMCT+ posts, the new service stations will be positioned as “rewards hubs”, linking fuel discounts to the broader LMCT+ ecosystem of memberships, promotions and giveaways.

While only one site is currently visible, industry chatter suggests the Preston location is just a starting point. One industry source familiar with the sector said expectations around the scale of the rollout are already far larger than a single Melbourne servo.

Despite increasing discussion around electric vehicles, analysts say traditional fuel retail remains commercially viable in the short to medium term, supported by strong hybrid sales and steady fuel margins.

For now, LMCT+’s petrol presence begins with a single rebadged site. But judging by the messaging coming from its social channels – and the reaction they continue to generate – Preston may be less a one-off experiment than the first marker in a much larger play.

The Australian federal government’s Clean Energy Finance Corporation (CEFC) is partnering with Hyundai Capital Australia (HCAU) to provide discounted finance on eligible electric vehicles from Hyundai and sister brand Kia.

The CEFC has committed up to $60 million to the scheme which aims to make EV ownership more affordable for both private and small business buyers. Under the initiative, eligible customers could save between 0.5 and one per cent per annum on their finance rate, depending on the model. According to the CEFC, a discount on the interest rate of one per cent on a $70,000 loan, could potentially save buyers over $1900 in interest costs over five years.

Eligible Hyundai and Kia electric vehicles must be priced under the Luxury Car Tax (LCT) threshold (currently $91,387) while the scheme applies only to full battery electric vehicles, and excludes hybrid and plug-in hybrid models.

Climate Change and Energy Minister Chris Bowen said the CEFC initiative was designed to make EV ownership more affordable for more people while also helping to reduce vehicle emissions.

“This CEFC investment will help lower the cost barrier for households and small businesses, making EV ownership more accessible,” said Mr Bowen. “Transport is one of our biggest sources of emissions, and electric vehicles are a key way we cut pollution while saving people money.”

Hyundai Capital Australia chief executive Donglim Shin said he hoped the CEFC investment could help the decision-making process for buyers who are considering the switch to electric cars, but are apprehensive about the costs.

“Electric vehicles are an important part of Australia’s mobility future but cost can be a barrier for many customers,“ Shin said. “Reducing the purchase price of the vehicles could help sway motorists who are considering low-emission options.

“Working with the CEFC allows us to offer discounted finance on eligible Hyundai Motor Group EVs, making ownership more achievable for Australian customers.“

The list of eligible Hyundai and Kia electric vehicles currently under the LCT threshold includes:

- Hyundai Inster

- Hyundai Kona Electric

- Hyundai Elexio

- Hyundai Ioniq 5

- Hyundai Ioniq 6

- Kia Niro

- Kia EV3

- Kia EV4

- Kia EV5

- Kia EV6

According to data from the Federal Chamber of Automotive Industries (FCAI) and Electric Vehicle Council, Australians bought a total of 103,269 battery electric vehicles in 2025, a record number representing 8.3 per cent of the total new car market and an increase of 13.1 per cent over the previous year.

As artificial intelligence traffic cameras become standard across Australia, concerns are mounting over their accuracy, particularly when it comes to detecting mobile phone and seatbelt offences. With AI-based enforcement now operating nationwide, a growing number of motorists are questioning infringement notices and taking their cases to court.

AI cameras are designed to automatically identify illegal mobile phone use and seatbelt breaches, capturing images that can lead to fines and demerit points. However, according to high-profile traffic lawyer at Astor Legal, Avinash Singh, the technology is far from foolproof. Singh warned that the systems frequently misinterpret common items as mobile phones.

“AI cameras are notoriously unreliable at detecting mobile phone use in particular,” Singh said. “The technology often mistakes other objects for phones. We’ve seen cases where wallets, glasses cases and even battery packs have been incorrectly flagged.”

Transport authorities across the country maintain that images captured by AI cameras are reviewed by trained human operators before penalties are issued. While this reassurance is intended to build confidence in the system, Singh says it raises further questions.

“If these images are genuinely being checked by people, it makes the volume of incorrect detections all the more concerning,” he said. “There’s no transparent way for drivers to verify how thorough that review process actually is.”

Legal professionals report that AI-generated infringements are now being regularly challenged, particularly in cases where the image evidence is unclear or open to interpretation. Singh is encouraging drivers who believe they’ve been wrongly fined to consider disputing the notice rather than paying it automatically.

“To challenge an AI-based fine, the driver must elect to take the matter to court instead of paying it,” Singh explained. “The case is then listed for a hearing, where a criminal defence lawyer can argue that the prosecution cannot prove beyond a reasonable doubt that the image shows a mobile phone.”

With AI enforcement expanding and penalties remaining severe, experts say scrutiny of the technology – and how it’s applied – is likely to intensify as more drivers push back against questionable fines.